Perfectly Prepared: Your QuickBooks Tax Prep Checklist

Tax season doesn’t have to be stressful. Ensure your QuickBooks Online file is accurate and tax-ready with this free webinar. This session will provide a structured approach to organizing financial records, minimizing errors, and streamlining the tax filing process.

What you’ll learn:

Balance Sheet Reconciliation to verify accuracy and completeness of accounts

Profit & Loss Review to identify and correct misclassified transactions

Chart of Accounts Mapping to ensure tax compliance and proper categorization

Generating CPA Reports to prepare essential financial statements for tax filing

Year-End Book Closing to properly finalize your books for a smooth transition

Bonus - Attendees will receive a free downloadable checklist to assist with ongoing tax preparation.

Optimize your financial processes and approach tax season with confidence. Sign Up Today!

Date and Time:

March 19th, 10 AM - 11 AM (PST)

Register here:https://bit.ly/41lw3At

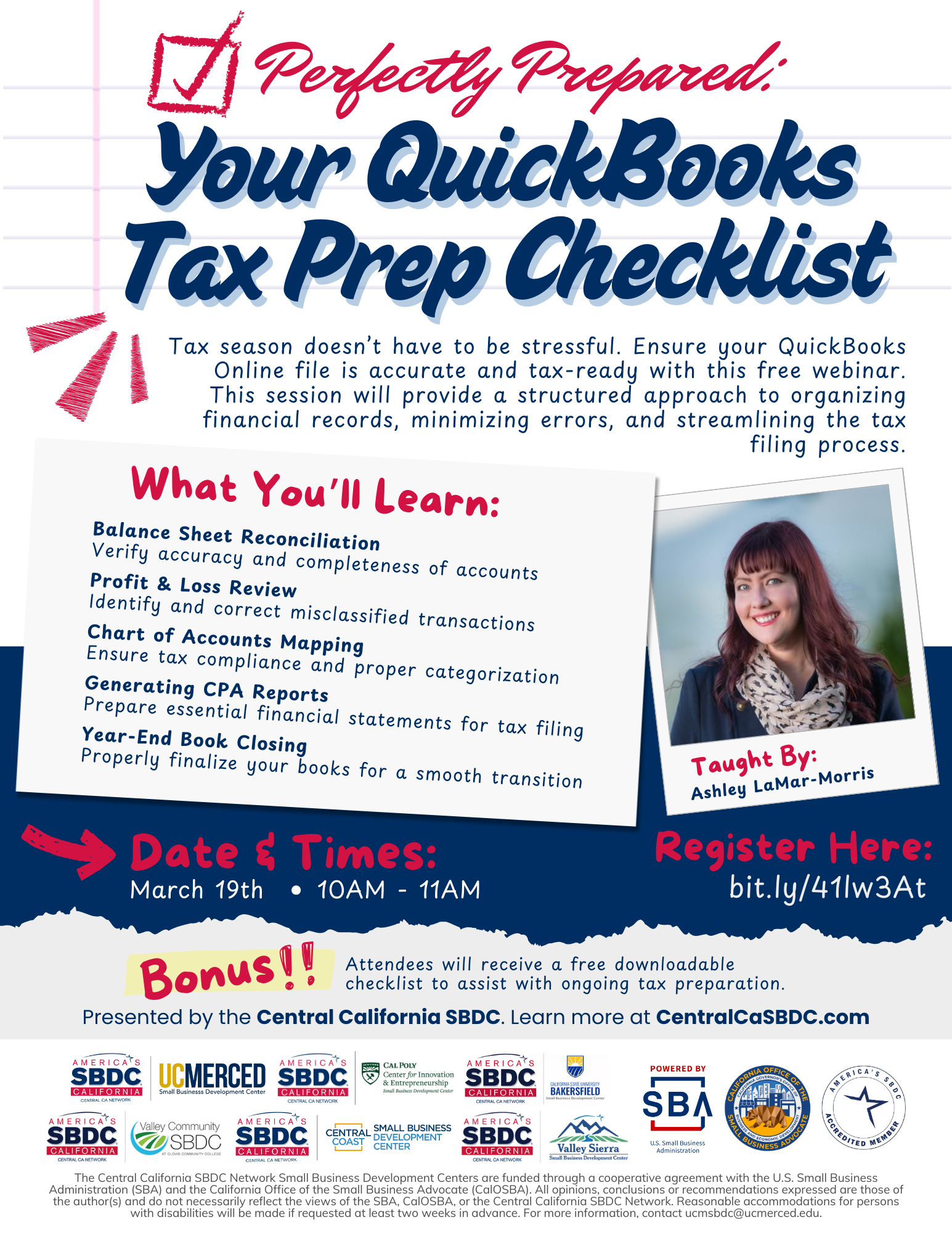

This Workshop is brought to you by Central California SBDC and taught by Ashley LaMar-Morris. With 18 years of experience specializing in QBO, from setup to cleanup, financial reporting, and tax preparation, Ashley works closely with business owners and CPAs to ensure financial accuracy and compliance. When she’s not balancing the books, she’s supporting animal rescue efforts—donating 10% of her revenue to cat charities. Small Business Development Centers (SBDC) provide quality business assistance to small businesses at no cost! Our business advisors provide clarity and pathways to get businesses off the ground and push current businesses to their full potential. Learn more here: https://centralcasbdc.com/